Using technology as an advantage by the private equity firms in London

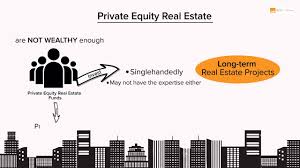

Private equity firms the UK are monetary entertainers that support speculation subsidies that raise billions of dollars every year. The assets regularly purchase out high-performing organizations utilizing high measures of obligation and plan to exchange them in a five-year window promising speculators outsized returns all the while. They propose to do this through a blend of operational upgrades and monetary designing procedures that separate assets from organizations, frequently leaving them monetarily powerless. Each organization, in each industry, is in the pains of an innovative and computerized insurgency. Private equity is no special case. Private equity firms currently approach uncommon volumes of information that can educate or wreck their venture choices. The brokerage firms London heads of tomorrow will be the individuals who influence innovation and information to illuminate all regarding their choices. Here are three manners by which a can flourish in the present al